Ron Johnson has nothing but contempt for the people he represents. There's really no other way to any other conclusion after reading Johnson's transparent fraud of an op-ed in

Politico today. If you read the piece today and merely thought it was merely a vapid attempt to sell Johnson's maiden work of legislation, don't worry, on the surface it had all the depth of a puddle of spit -- but what it lacked in substance the essay made up for in a stunning ulterior motive.

It's a flagrant attempt to use the people of Wisconsin, and specifically the small business owners of the state, to shill for Wall Street only Johnson doesn't have the backbone to come out and say it. Every last voter in the Badger state should feel insulted by this pathetic attempt to pull a con job by someone who clearly thinks he's more clever than the voters who elected him.

A little background before we get started: During the 2010, Johnson provided

the following exchange during an interview:

LIB: That tends to suggest an answer,

but let’s just make it clear – what would your suggestions be toward

fixing the crisis that we’re now in?

RJ:

Well we absolutely have to reform Fannie and Freddie, first of all.

And that, truthfully, I would be looking back to banking rules and

regulations back since the ‘60s, ‘70s and ‘80s in terms of things

working. I would seriously take a look at these banks that are still

termed “too big to fail,” and maybe we need to orderly break them up

under anti-trust laws.

So last year Johnson was in favor of

massive government intervention into financial institutions. Today he believes the banks should be left to their own devices. And who did he decide to team up with to co-author the essay that informed the world of his new policy position? None other than a former Wall Street CEO.

It's as complete a total disavowal of one's independence as you'll ever see.

Johnson's article today completely disavows this position. He doesn't just flip-flop, the act of political conservationism required to pull this requires an audacity level that should awe even the Romanian judge.

It's of paramount importance to keep in mind that Johnson is just the co-author of this piece. His partner in crime is a man named John Allison, who is a former chairman and CEO of

BB&T. What's a BB&T, you ask? Good question. Here's how they describe themselves on their

web site:

BB&T Corporation, headquartered in Winston-Salem, N.C., is among the nation's top financial-holding companies with $159 billion in assets and market capitalization of $18.7 billion, as of June 30, 2011. Its bank subsidiaries operate approximately 1,800 financial centers in the Carolinas, Virginia, West Virginia, Kentucky, Georgia, Tennessee, Maryland, Florida, Alabama, Indiana, Texas and Washington, D.C. Market share rankings in deposits: No. 1 in West Virginia; No. 3 in the Carolinas and Virginia; No. 4 in Kentucky; No. 5 in Alabama, Florida and Georgia; No. 6 in Tennessee; No. 7 in Maryland and Washington, D.C. (June 30, 2010 FDIC Deposits, SNL).

So it's a massive regional bank in the South (you may have noticed that BB&T does not have a presence in Wisconsin), but that's only half of Allison's story. One of Allison's extracurricular activities includes Ayn Rand worship. From the

New York Times:

Speaking at a recent convention in Boston to a group of like-minded

business people and students, Mr. Allison tells a story: A boy is

playing in a sandbox, only to have his truck taken by another child. A

fight ensues, and the boy’s mother tells him to stop being selfish and

to share.

“You learned in that sandbox at some really deep level

that it’s bad to be selfish,” says Mr. Allison, adding that the mother

has taught a horrible lesson. “To say man is bad because he is selfish

is to say it’s bad because he’s alive.”

If Mr. Allison’s speech sounds vaguely familiar, it’s because it’s based on the philosophy of Ayn Rand,

who celebrated the virtues of reason, self-interest and laissez-faire

capitalism while maintaining that altruism is a destructive force. In

Ms. Rand’s world, nothing is more heroic — and sexy — than a

hard-working businessman free to pursue his wealth. And nothing is worse

than a pesky bureaucrat trying to restrict business and redistribute

wealth.

Freud would have a field day. Allison's Rand fetish extends, rather absurdly I might add, to

funding Ayn Rand classes, studies and the distribution of her works at universities, which, in essence, is

charitably giving to teach people how to be

selfish. Unwrap that mindfuck if you can.

Allison is as zealous a "free market" evangelist as they come, so much so that he can't even conceive how anything other than the government was responsible for

the current economic crisis. I'd link to more examples, but there really is no shortage of Allison pontificating at libertarian mutual appreciation societies like the

Competitive Enterprise Institute, the

Ayn Rand Center and other places online.

So in a time of unparalleled economic uncertainty on Main Street, Johnson runs to find his friends on Wall Street. Keep that in mind because every last line of this essay aims to serve Johnson's masters in lower Manhattan, not Wisconsin.

Johnson/Allison start off their their piece with a little joke that you will be forgiven for missing upon a cursory reading:

Most people go

into business because they want to make the world better by building

something — and, of course, to make money for themselves and the people

working with them.

Ha ha. Get it? Money, of course, always plays second fiddle to the altruistic impulses of entrepreneurs everywhere. The winking and elbow-poking doesn't even need to be included in the stage directions of this monologue.

Yet business leaders today are routinely treated as

guilty until proven innocent by the bureaucrats in our regulatory

agencies.

This is an asinine statement, as we'll demonstrate using Johnson/Allison's own example below.

Our regulatory state strangles economic growth. Regulations bar many

voluntary agreements and subject businessmen to constant

micromanagement.

Here's Johnson/Allison's thesis: regulation is bad for business Judging by the vagueness of the statement, one assumes Johnson/Allison is referring to all businesses, and that's certainly what they want you to believe, but they're really only talking about the banking forthcoming banking regulations coming soon to house of finance near you courtesy of the Dodd-Frank Act.

Aside from being completely disingenuous, Johnson/Allison's thesis also suffers from two additional problems: 1.) there's really not very much empirical evidence to suggest this is true and b.) regulations tend to be

very good for big businesses. Both of these points will be elaborated upon later.

Absent concrete evidence to support their claim, Johnson/Allison provide their readers with stray observations, like:

At the federal level alone, business is subject to tens of thousands

of regulations. The federal regulation code, which lists them, currently

stands at 160,000 pages. Over the past 15 years, business has been hit

with almost 60,000 new federal rules, to say nothing of state-level

regulation. Compliance costs alone surpass $1.75 trillion annually,

according to the Small Business Administration.

(It's actually called the Code of Federal Regulations, which tells you just how much interaction the authors have with federal regulations ... or

the internet, for that matter.)

A quick note about this SBA study from Bruce Bartlett, one of Reagan's senior economists:

When pressed for data to support their argument that deregulation is a

magic bullet that will turn the economy around, conservatives often

point to a study commissioned by the Small Business Administration

and published in September 2010. The study was performed by economists

Nicole Crain and Mark Crain of Lafayette College. However, there are a

number of problems with relying on this source.

For one thing, the

analysis stops in 2008. To the extent that the SBA study tells us

anything about the cost of regulation, it says that the Bush

administration was extremely lax about reducing a burden that

Republicans now say is the economy’s biggest problem. A Congressional Research Service study

has also identified important methodological weaknesses in the SBA

study that cast grave doubt on its validity. CRS noted that some of the

sources used to calculate regulatory costs appear to have been misused

or misinterpreted, some cost figures were cherry picked to provide the

highest possible cost estimate, and many of the estimates are from

studies done decades ago with little contemporary value.

So it's a dubious source ... and not the first time that Johnson has

relied on one.

Later on, Johnson/Allison will decry regulations as being "job killers," but it actually seems to sound like compliance is something of a growth industry. Regardless, the 160,000 page

Code of Federal Regulations covers

all federal regulations and only a fraction of it ever actually applies to a given business based on its industry. Johnson/Allison are guilty of shamelessly and vastly exaggerated the problem.

This explosion of new regulations dramatically reduces job creation.

Or, not so much. Here's more from Bartlett:

Efforts to find specific regulations that are hampering business

expansion and employment growth have not actually found any. While

business groups based in Washington will quickly rattle off a list

starting with the Affordable Care Act, surveys of actual businesses

paint a different picture. When McClatchy newspapers interviewed a

number of small business owners to see what regulations are holding them

back, it couldn’t find any.

“None of the business owners complained about regulation in their particular industries, and most seemed to welcome it,” the McClatchy report

found. Monthly surveys by the National Federation of Independent

Business show that small business concerns about regulation are lower

today than they were in the 1990s when the economy was booming.

Note that Johnson/Allison calls them "new regulations," which, again, refer to those prescribed in the Dodd-Frank Act. If you still aren't convinced of this, the authors are about to say so explicitly:

The more costly it is for businesses to meet regulatory demands, the

fewer workers they can hire. When government ramps up regulations in

unpredictable ways — see Obamacare, Dodd-Frank Wall Street regulations

and the Environmental Protection Agency under Lisa Jackson — businesses

are more likely to build cash reserves than they are to invest and hire.

Did you catch that? Blink and you missed it, but we've actually just arrived at the heart of this essay: "Dodd-Frank Wall Street regulations." Remember: John Allison is a former banker and banks aren't exactly high priorities for the EPA. Johnson/Allison talk about an "explosion of new regulations," which is shorthand for the Dood-Frank bill. That's really the only game in town in terms of newsworthy regulatory guidelines coming down the pipeline.

Small-business owners are asking why banks won’t make loans to help

them expand and create jobs. The answer is simple: The banking

regulators have radically tightened lending standards. Ask any community

banker.

Why ask any community banker when you have the former CEO of a massive regional bank? The fact that Johnson is writing this with a multimillionaire and not, say, a small business owner from Oshkosh speaks volumes about whom he's working for.

Regulatory bureaucracies also stifle innovation, which is the key to

economic growth but requires defying convention, experimenting, making

mistakes and correcting them. That isn’t compatible with the regulatory

state’s demand for obedience to mind-numbing rules. Half the challenge

for innovators now is getting past the regulator. As a result, many

avenues of exploration just aren’t pursued.

I always enjoy this line of thought: apparently their are brilliant innovators in the world that can invent mind-blowing new products, create awesome new services and, most importantly, solve problems that have plagued mankind from time immemorial, but can't seem to figure out the ancient riddle of the Health Inspector.

Perhaps the regulatory state’s toughest burden, however, is that it

discourages our best entrepreneurs.

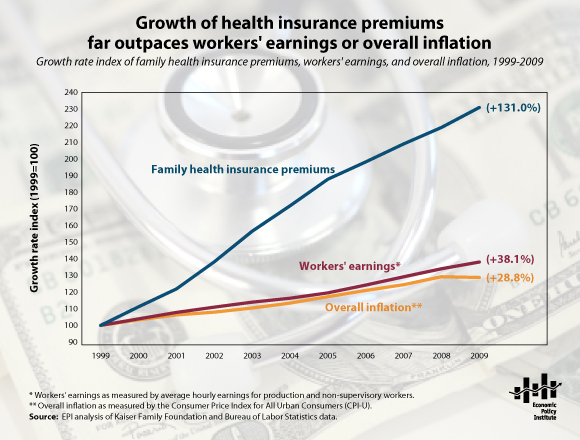

This chart suggests otherwise:

Productive individuals face a daily

grind of trying to comply with an endless number of rules — often

arcane, arbitrary and contradictory. By treating entrepreneurs as latent

criminals, the regulatory state crushes the creative spirit — and

wastes the energy and talents of the job producers and the prosperity

producers.

Notice how the entire essay is very much a touchy-feely load of shit about a "productive spirit" and "discouragement" and "creativity," etc.? There isn't a single example of actual data included in Johnson/Allison's piece and the only numbers I see relate to the page lengths of various government documents. Maybe this sort of appeal to the reader's aspirations works on a rhetorical level, but it's shitty policy.

A recent series of studies by the

Institute for Justice examined the morass of regulations strangling

commerce in many U.S. cities.

What's the Institute for Justice? It's actually more of

a law firm than an "institute," but one that eschews private clients to dabble in public affairs. Think of it more along the lines of an

amicus brief factory that occasionally whips up a white paper or two.

It's also funded by the

Koch Foundation.

In Los Angeles, for example, people who

want to open a restaurant may spend months, even years, jumping through

regulatory hoops before they’re able to serve their first customer.

There are business licenses, zoning requirements, scores of permits and

approvals and a seemingly endless number of taxes and fees.

All told, L.A. restaurateurs have to go through at least a dozen

government agencies before opening their doors. The process is so

complex, the city published a 147-page handbook to explain it.

Here's a list of all the restaurants in Los Angles County that suffered closures due to health code violations during a three month period

this summer. It's enormous and includes restaurants like Burger King, Baskin Robbins, Boston Market, Denny's, Dominoes, Jack in the Box, KFC, McDonald's, Panda Express, Pizza Hut, Popeye's, Sonic, Starbuck's, and Subway -- all chains that should be health code compliance ninjas given their resources and experience (to say nothing of the more reliable revenue stream that comes with being a national chain).

Go ahead and see what each restaurant got cited for -- you won't eat out for a month. Now if the big boys can lapse from time to time and fail to find the initiative to keep a tidy shop, what do you think will happen in the really incompetent restaurateurs' kitchens?

One of the many reasons people go to fast food chains, like the ones listed above, is because they have an expectation of healthy and sanitation based on their ubiquity and financial success, but according to Johnson/Allison these "business leaders" are being "routinely treated as

guilty until proven innocent by the bureaucrats in our regulatory

agencies." It simply does not occur to the authors that the nature of their business may actually make their periodic guilt inevitable.

Would you be willing to go through that to start a business?

Thousands of people are willing to do just that

if only they could acquire the money.

When

America’s businessmen find themselves discouraged and dispirited, we all

lose. We lose out on jobs, new products and a rising standard of

living.

Building a business is hard work. As retired businessmen, we can attest

to the long hours, sleepless nights, overloaded schedules, ongoing

setbacks and other daunting challenges that go into creating a

successful business.

This is probably the most interesting graph in the entire essay and the moment when Johnson/Allison interject themselves into the argument. But something's missing, and if you noticed a complete lack of relevant anecdotes from either Johnsons's or Allison's personal experience, you've hit the nail on the head.

The omission exists for several obvious reasons: talking about restaurateurs in LA makes the authors appear more like Everymen and less the millionaires they actually are. Both men have long had others take care of their regulatory issues for them. The example also makes regulations seem like the reach of government is long (literally spanning across the entire country!) and personal. Also, Allison's former life as and banking CEO isn't a very popular profession right now, while Johnson lived

a pretty charmed life when he was just a plastics manufacturer from the sticks.

I bring this up because the federal government really

can't do anything about the restaurateur from LA's regualtory burden -- those are mostly state and local laws. Johnson may not be able to stick up for Carlos and his Taco Truck on Venice Beach ... but he can do wonders for the former banking CEO who co-signed the byline.

To persevere, business men and women need the freedom to run their

businesses by their own best judgment. They cannot function if they have

to spend a quarter, a half or even more of their time taking orders

from bureaucrats.

So which one is it? Do business folks spend 25%, 50% or even more of their time dealing with Uncle Sam? Johnson's colleague in the House, Sean Duffy, recently made the mistake of trying to assign hard numbers to compliance costs and

fell flat on his face, which may have a lot to do with why Johnson plays coy here. Or possibly the numbers aren't that big and vary widely from industry to industry, but only seem to do the most harm to -- wait for it --

the banking sector.

Either way, by now we've identified the problem -- so what's the solution?

It’s time to stop the parade of new regulation until we can begin to

roll it back. The new regulation moratorium bill is a good first step.

It would block new regulations until unemployment falls below 7.8

percent — the rate when President Barack Obama took office.

Now would be a good time to remind you, once again, that this "parade of new regulation" is the Dodd-Frank Act.

The regulatory moratorium is legislation which Johnson has authored and what we've called in the past "

a snotty, deeply cynical bill that is little more than a flaming bag of dogshit left on the White House front porch." This essay does nothing to convince us that we wrong to say as much. The 7.8% figure is arbitrary, not based on economics, and exists solely for political purposes, just like the rest of the legislation. It's a truly worthless waste of time and energy.

One of the reasons a regulatory moratorium will never happen, to say nothing of possibly work, is because big business actually

loves regulations. It's counter-intuitive, but what Johnson/Allison might call "entrepreneurial innovation" Big Business calls "competition" and competition is bad for the bottom line. That's one of the reasons Title 21, Chapter 483 of the Code of Federal Regulations is as big as it is: larger long-term care providers are trying to squeeze out competition by making start-up nursing homes operate on the same playing field,

even if they don't have the same resources. No one came to congress with a fresh new prospective on how to reform Nursing Home regulation, but

HCR ManorCare sure as hell does and you can bet it includes regulations that would be vastly unfair to the Mom n' Pop Old Folks Home down the street from you.

There’s a lot of talk today about how to “stimulate” the economy. A free

economy does not require “stimulation.” It is fueled by the passion and

creativity of profit-seeking business leaders.

The problem is not lack of stimulus but the suffocating weight of

government intervention. If we want to revive the economy, it’s time to

liberate the victims of our regulatory state.

Vice Presidents of Regulatory Compliance of the world, UNITE!

So why all the fuss from Johnson over regulations? It's basically because that's all that's left. Here's

Bruce Bartlett yet again:

Republicans have a problem. People are increasingly concerned about

unemployment, but Republicans have nothing to offer them. The G.O.P.

opposes additional government spending for jobs programs and, in fact,

favors big cuts in spending that would be likely to lead to further

layoffs at all levels of government.

Republicans favor tax cuts for the wealthy and corporations, but these had no stimulative effect during the George W. Bush administration

and there is no reason to believe that more of them will have any

today. And the Republicans’ oft-stated concern for the deficit makes tax

cuts a hard sell.

These constraints have led Republicans to embrace the idea that government regulation is the principal factor holding back employment. They assert that Barack Obama

has unleashed a tidal wave of new regulations, which has created

uncertainty among businesses and prevents them from investing and

hiring.

No hard evidence is offered for this claim; it is simply asserted as self-evident and repeated endlessly throughout the conservative echo chamber.

The vast emptiness of Johnson/Allison's essay is certainly a testimony to that observation. Johnson's previously efforts to solve the deficit were embarrassing and clearly not going anywhere. His devotion to the anti-tax voodoo that has held the GOP hostage for the last 30 years shows

signs of breaking. Strictly from a policy perspective, what's left after this cover is blown off this regulatory nonsense?

What makes this all worse is that Johnson actually

supported breaking up banks that were "

too big to fail," possibly the ultimate form of banking regulation, during his campaign during the 2010 campaign. Now he's skipping hand-in-hand with a bank CEO decrying any regulation whatsoever. It was this type of hypocrisy that Johnson claims inspired him to run for office in the first place.

Such sound and fury...