[A]s [City Manager Phil Batchelor] talked about the bankrupting of Vallejo, I realized that I had heard this story before, or a private-sector version of it. The people who had power in the society, and were charged with saving it from itself, had instead bled the society to death. The problem with police officers and firefighters isn’t a public-sector problem; it isn’t a problem with government; it’s a problem with the entire society. It’s what happened on Wall Street in the run-up to the subprime crisis. It’s a problem of people taking what they can, just because they can, without regard to the larger social consequences. It’s not just a coincidence that the debts of cities and states spun out of control at the same time as the debts of individual Americans. Alone in a dark room with a pile of money, Americans knew exactly what they wanted to do, from the top of the society to the bottom. They’d been conditioned to grab as much as they could, without thinking about the long-term consequences.

Thursday, September 29, 2011

Weekend Homework

If there's one piece of long form journalism you decide to read while waiting for the Badger-Nebraska game this weekend, make it Michael Lewis' latest in Vanity Fair. A taste (or, more likely, the very point of the whole thing):

Wednesday, September 28, 2011

The Most Comprehensive Scott Walker/John Doe Investigation Timeline You're Going to Find

2005

We also recommend reading the Criminal Complaint filed against Gardner in April, from whence much of the information above was derived.

The GAB fines Wisconsin and Southern Railroad (WSOR) CEO William Gardner $1,000 for contributing $5,000 to Scott Walker's campaign for governor. As a registered lobbyist, Gardner was prohibited for making any campaign contributions.2009

November

17: The Walker campaign returns Garder's donation and accepts a $5,000 contribution from his daughter, Stephanie Schladweller.

April

27: Scott Walker officially announces his candidacy for Governor.

September

After meeting on Sugardaddyforme.com, Florida resident Stacie Long moves into Gardner's apartment in Hartford.November

19: Gardner donates $5,000 to Friends of Scott Walker, asks Walker to call him on his cell phone.

~20: Gardner expenses his donation.

December

10: Gardner recieves an email confirming a breakfast meeting with Walker.

14: WSOR employee Steve Breske donates $5,000 to Friends of Scott Walker at Gardner's request and is later reimbursed by WSOR.

14: Stacie Long donates $10,000 to Friends of Scott Walker. The money was given to her by Gardner.

14: Gardner donates $5,000 to Friends of Scott Walker.

15: WSOR employee Jeff Lombard donates $5,000 to Friends of Scott Walker at Gardner's request and is later reimbursed.

21: Garner meets Walker at the Crowne Plaza in Milwaukee.

2010Late December: Long and Gardner have a falling out that leads to a prolonged dispute over property of Long's that was retained by Gardner.

February

~February: Garnder solicites WSOR employee Ken Lucht to donate to the Walker campaign and is given $5,000 to do so, but never does.March

3: WSOR employee Bernard Meighan donates $5,000 to the Walker campaign after being asked by Gardner. He's later reimbursed by WSOR.

2: WSOR employee David Hackbarth donates $4,900 to the Walker campaign and is later reimbursed.

2: WSOR employee Dale Thomas donates $4,900 and is later reimbursed.

16: Gardner informs Walker campaign fundraiser that Meighan and Lucht will be donating.April

13: Gardner meets with Walker at Noodles in Madison.

15: Gardner emails Walker to thank him for a meeting, concluding his message:

Keep up the good work and I will do everything I possibly can to get you in the Governors Mansion... ... ... ....19: Stacie Long contacts the GAB regarding Gardner's donations.

bg

25: Gardener asks two additional WOSR employees to donate $4,900 to Walker's campaign. They refuse.May

10: GAB begins an investigation into Gardner's political contributions.

13: Darlene Wink resigns her position as a constituent services director in Scott Walker's office for using county computers to post political messages on the Journal Sentinel web site. Authorities later confiscate her work computer and executed a search warrant of her home. She also served as the vice chairwoman of the Milwaukee County Republican Party.

18: Gardner discloses the illegal contributions to the GAB.

18: The Walker campaign returns Gardner's money.

21-23: WisGOP convention in Milwaukee. Walker wins the party endorsement for Governor.

June

24: A search warrant is executed at WSOR.August

20: Walker aide Tim Russell has his county computer seized by the Milwaukee DA.September

14: Walker wins GOP primary.

~September: Cullen Werwie joins the Walker campaign after working on Brett Davis unsuccessful bid for Lt. Gov.November

2: Walker wins general election.

3: Walker campaign treasurer John Hiller is named transition director.

~November: Scott Walker campaign receives a subpoena for campaign emails in the Gardner investigation and hires former US Attorney Steven Biskupic as counsel.

~November: Attorney General JB Van Hollen refuses a request to investigate impropriety in Scott Walker's Milwaukee County Executive office.December

21: Rose Ann Dieck is given immunity in the John Doe investigation.

201129: Walker names his cabinet and senior staffers. Cullen Werwie is named spokesman.

January

3: Walker is sworn in as Governor.

14: Lucht is given immunity in the John Doe investigation.March

10: Walker signs the controversial budget bill rolling back many collective bargaining rights for public workers. Lost in the controversy is a provision in the bill that transforms 37 civil service jobs into political appointments.

11: Walker administration announces a grants of $3,647,149; $11,084,39; and $1,454,594; and loans of $455,894 and $1,108,439 loan to repair bridges in Wisconsin.April

11: A criminal complaint is filed against Gardner in Washington County. Gardner pleads guilty two felony counts and agrees to serve two years probation. WSOR agrees to pay a civil forfeiture of $166,900.

May14: Walker Spokesman Cullen Werwie is given immunity in the John Doe investigation.

11: Department of Workforce Development secretary Manny Perez abruptly resigns his position after just over four months on the job.

11: Walker Campaign treasurer John Hiller is replaced by Kate Lund.

July

18: Long-time Walker chief of staff Tom Nardelli steps down as administer the department of Safety and Buildings and takes a job as administrator of the state Division of Environmental and Regulatory Services.

21: Tom Nardelli resigns his position in the Division of Environmental and Regulatory Services.August

19: Long-time Walker aide Cynthia Archer leaves position as deputy secretary of the Department of Administration to become legislative liaison in the Department of Children and Families, a job she was given a day earlier.

22: This is supposed to be Cynthia Archer's first day in her new job, but she uses six weeks worth of accrued sick leave and delays completing the transition.

25: Children and Families Secretary Eloise Anderson interviews Heidi Green for the legislative liaison job taken by Archer.September

14: Cynthia Archer's home is raided by the FBI.

21: Cynthia Archer is removed from the Walker's Fraud Detection committee.

22: Attorney General JB Van Hollen announces the Department of Justice will not investigate Cynthia Archer.

Did we miss anything? Let us know in the comments.23: 2001: WisDOT announces a grant of $1,063,200 and $132,900 loan for WSOR.

We also recommend reading the Criminal Complaint filed against Gardner in April, from whence much of the information above was derived.

Paul Ryan Delivers an Economic Speech at a Think Tank Named after Herbert Hoover

I'm pretty sure I'm the only person in the world who finds irony in this juxtaposition because it happens all the time.

Paul Ryan gave a speech devoted to repealing and replacing Obamacare at the Hoover Institute yesterday. As we've noted in the past, Ryan tends to reserve his big guns for speeches at think tanks and in academic settings.

We'll probably get around to talking about the speech and the contents therein this weekend. Or not. If there's one sort of take-away line from the whole thing I'd point to this passage:

Here's the video:

Paul Ryan gave a speech devoted to repealing and replacing Obamacare at the Hoover Institute yesterday. As we've noted in the past, Ryan tends to reserve his big guns for speeches at think tanks and in academic settings.

We'll probably get around to talking about the speech and the contents therein this weekend. Or not. If there's one sort of take-away line from the whole thing I'd point to this passage:

The three reforms I’ve just outlined – premium support for Medicare, block grants for Medicaid, and tax reform to correct the inefficient tax treatment of health insurance – must be present in our “replace” agenda.Say what you will about Ryan, the guy has a gift for encapsulating both the policy and the politics of a heavy issue rather succintly.

If we end up with a replace agenda that fails to fix the problem, then we will lose hard-won credibility on the health-care issue as a result.

Here's the video:

Tuesday, September 27, 2011

Wisconsin & Southern Railroad Received a Huge Grant from the State the Week their Chief Lobbyist's Immunity Deal was made Public

This little bit of news came to us by way of one of the comments to our last post:

The day before the news that the chief lobbyist from Wisconsin & Southern Railroad had been granted immunity in the ongoing John Doe investigation Wisconsin and Southern received a substantial grant from the Walker administration:

MORE: Some more WSRR news:

EVEN MORE: For the conspiratorially-minded, I'd actually consider looking at the above addendum a little more carefully, especially because it was written almost a week before news of the immunity deals broke. A number of questions bubble up in light of the recent events.

The most important are: why would WSRR agree to open it's books to state officials in 2008 and not want to do so today? It's unclear whether WSRR has provided the information to the consortium in the past -- if it has done so, what could have occurred in the interim to discourage them from doing so now?

The day before the news that the chief lobbyist from Wisconsin & Southern Railroad had been granted immunity in the ongoing John Doe investigation Wisconsin and Southern received a substantial grant from the Walker administration:

The state has awarded the Wisconsin & Southern Railroad Co. a $6.9 million grant to improve a section of freight rail line running between Saukville and Elkhart Lake, Gov. Scott Walker announced Thursday.Nice catch.

[...]

The money was part of $17.5 million in grant and loan funding awarded this week by the state to construct freight rail-related facilities, and preserve and upgrade rail infrastructure.

"Wisconsin's freight rail system plays a major role in our state's economy, moving raw materials to industry and finished products to markets," Walker said in a news release. "These awards will help support economic growth in communities across our state and help ensure Wisconsin remains open for business."

The grant will cover 80 percent of the project's $8.7 million price tag. The state also will provide an $867,181 loan to assist with the project, while the remainder will be paid for by the railroad and the East Wisconsin Counties Railroad Consortium.

MORE: Some more WSRR news:

A group charged with oversight of regional rail lines and funds used to improve railroad infrastructure will review financial records from Wisconsin and Southern Railroad for the first time in three years.If the struggle between keeping proprietary information private and open records law enthralls you, then you'll love the rest of the article.

The East Wisconsin Counties Railroad Consortium voted unanimously to have the consortium's chairman, vice chairman, treasurer and corporation counsel meet with Wisconsin and Southern CEO William Gardner later this year to review the privately held company's 2010 financial records.

But Gardner has refused to provide hard copies of audits, quarterly financial reports and other documents the consortium is entitled to review under an agreement the parties signed on March 28, 2008.

[...]

Wisconsin and Southern has agreements with the DOT and the consortium that allow it to use the tracks in the region, as well as tap into $30 million in statewide funds and $225,000 in consortium funds to pay for rail infrastructure improvements.

The consortium is made up of nine counties that each contribute $25,000 per year to help maintain rail lines and infrastructure in the region. Each county is represented by two county board supervisors.

EVEN MORE: For the conspiratorially-minded, I'd actually consider looking at the above addendum a little more carefully, especially because it was written almost a week before news of the immunity deals broke. A number of questions bubble up in light of the recent events.

The most important are: why would WSRR agree to open it's books to state officials in 2008 and not want to do so today? It's unclear whether WSRR has provided the information to the consortium in the past -- if it has done so, what could have occurred in the interim to discourage them from doing so now?

Friday, September 23, 2011

Everyone's Favorite John Doe Investigation just went from Interesting to Downright Sexy

If there's such a thing a speculative corruption porn -- and let's face it, there is -- then today's JDI news should be this month's centerfold:

First, the fact that immunity has been granted means investigators believe the grantees know something. Maybe they do, maybe they don't, but the investigators think that granting them immunity will further their case. This says a lot about how far along the investigation is and where it is headed.

Which just so happens to be reason #2. Heretofore, the investigation appeared to be limited to Milwaukee County employees campaigning for Scott Walker on tax-payer time (and possibly using public resources), but the news that immunity has been given to a lobbyist for Wisconsin & Southern Railroad brings back a story most assumed was dead a year and a half ago:

This is a completely different ballgame and suggests, not only misappropriate use of public office, but also wholesale corruption and bribery: the presence of Kenneth Lucht on the immunity roster seems to indicate that Walker may have been aware of Wisconsin & Southern Railroad Co and/or Robert Friebert's plan to launder campaign donations through various employees. If Walker was aware of the scheme, and since the "donations" exceeded the legal limits, this could open up the potential for bribery allegations against the Governor.

Now that's all the worse case scenario, but that possibility didn't exist in the public imagination as early as this morning. The scope and the potential consequences of the John Doe Investigation just got a whole lot larger today.

MORE: Dan Bice has more on when immunity was granted for several of the players:

A report from WisPolitics.com out today reveals that Gov. Scott Walker's spokesperson, Cullen Werwie, and two other individuals have been granted immunity in the ongoing John Doe investigation (outlined earlier by dane101 here).Why is this news suddenly so sexy? Two reasons:

"Rose Ann Dieck, a retired teacher and Milwaukee County Republican party activist, and Kenneth Lucht, a lobbyist for the Wisconsin & Southern Railroad, have also been granted immunity in matters 'still under inquiry' through the secret probe, according to the judge overseeing the case."

First, the fact that immunity has been granted means investigators believe the grantees know something. Maybe they do, maybe they don't, but the investigators think that granting them immunity will further their case. This says a lot about how far along the investigation is and where it is headed.

Which just so happens to be reason #2. Heretofore, the investigation appeared to be limited to Milwaukee County employees campaigning for Scott Walker on tax-payer time (and possibly using public resources), but the news that immunity has been given to a lobbyist for Wisconsin & Southern Railroad brings back a story most assumed was dead a year and a half ago:

Wisconsin & Southern Railroad Co.'s top official reported to state regulators this week that he used company money to reimburse employees for making political donations.Yeah, a mistake...

Donating corporate money to political candidates in Wisconsin is illegal.

The situation prompted Milwaukee County Executive Scott Walker to return $43,800 in donations on Wednesday.

Robert Friebert, an attorney for railroad President and CEO William E. Gardner, said the donations were made to the gubernatorial campaign of Walker, as well as other campaigns he declined to name.

"Bill Gardner has self-reported these incidents and is fully cooperating," Friebert said. "What occurred was a mistake and were unintentional acts on his part."

This is a completely different ballgame and suggests, not only misappropriate use of public office, but also wholesale corruption and bribery: the presence of Kenneth Lucht on the immunity roster seems to indicate that Walker may have been aware of Wisconsin & Southern Railroad Co and/or Robert Friebert's plan to launder campaign donations through various employees. If Walker was aware of the scheme, and since the "donations" exceeded the legal limits, this could open up the potential for bribery allegations against the Governor.

Now that's all the worse case scenario, but that possibility didn't exist in the public imagination as early as this morning. The scope and the potential consequences of the John Doe Investigation just got a whole lot larger today.

MORE: Dan Bice has more on when immunity was granted for several of the players:

Former Appeals Court Judge Neal Nettesheim, who is overseeing the secret criminal probe, said he had granted immunity to three people, including Cullen Werwie, spokesman for Walker, in this part of the case. Records show he was granted immunity April 14.So these folks have had immunity for sometime now. This obviously takes a lot of the dramatic wind out of the news' sails.

[...]

Lucht is the manager of community development with Wisconsin & Southern Railroad. His attorney could not be reached late Friday. He received immunity on Jan. 14.

Dieck, a longtime Republican operative, is listed as the chairwoman of the southwest surburban branch of the Milwaukee County Republican Party. She was granted immunity on Dec. 21.

More on Tax Equality

There's something we wanted to add to a post we did the other day in light of some new info. Paul Krugman has this nifty little chart out today that's worth discussing in some detail:

Translation:

The first was that 25% of households earning between $20-30k actually pay more than the 15% their tax bracket requires of them. The effective tax rate for most households is usually less than their bracket and this is the only group for which this appears not to be the case. By our estimate that's about 2.8 million households, all of them in the fourth quintile of income earners in the United State, that are "overpaying" on their federal taxes. These are working class, hourly wage-earners, probably on the young end of things.

This seems odd, though we can think of a few reasons why this is the case. More on this later.

There are a number of effective tax rates that are comparable or higher to the median millionaires' rate for incomes well below seven figures. Krugman actually sells his point short about the number of wealthy people paying lower rates then their underlings: it's not just the bottom 40% of millionaires, it's probably most of them.

Which led us to this curious observation: the median effective tax rate paid by millionaires is actually less than it is for earners making $500,000-999,999 ... and by almost an entire percentage point too. That got us thinking: is this just a bump in an otherwise upward progression or does it essentially mark the crest of a "hook"?

There are a few numbers to suggest that this is actually the case. First, there are the incomes over $10 million:

As luck would have it, Forbes just published it's annual list of the 400 wealthiest Americans this week, so these are the folks we're talking about here. Last on the list is the Washington Redskin's less-than-popular owner Daniel Snyder at $1.05 billion.

So it would seem that once you become a millionaire in America, your effective tax rate actually decreases on average. Naturally, it's a little more complicated than that. We broken down some tax data from 2009 and found that the threshold is just a little bit higher:

This shouldn't be too surprising. Rich folks have more tax loopholes and charitable write-offs to take advantage of than the folks who were "overpaying" earlier. Those guys are likely on their own when it comes to tax breaks.

All too often folks defend the wealthy against charges of not paying their fair share by clumping them together in a group, as if they earned their wealth together as some kind of collective. The fact is that wealthy folks are individuals and as such they appear to be paying a lower effective tax rate than millions of people who earn less than they do. This comes after a generation spent giving Americans in the 40-99 percentile of earners more of the federal tax load since 1970, as this chart below shows:

Which looks like this in graph form:

Every time you see a line swerve above the green line in represents a raise in the tax rates. You can see this only happens for people not in the upper 1% of income earners. The rich have had a very nice run of things for the last generation and have given the country very little to show for it. It's time they give a little back.

* I basically took the data from three different years and combined them in order to extrapolate figures for recent years that I could not find. Is this shitty analytics? You bet, but it's the best I could do while killing an hour waiting for a phone call. If you can correct the numbers, by all means, do your stuff.

Translation:

Here’s how to read this: 40 percent of taxpayers with incomes between 30K and 40K pay more than 12.9 percent of their income in income and payroll taxes; meanwhile, 25 percent of people with incomes over $1M pay less than 12.6 percent of their income in these taxes. This suggests that there are a lot of very-high-income guys paying a lower tax rate than their secretaries.There were a number of things that caught our collective eye on this chart:

The first was that 25% of households earning between $20-30k actually pay more than the 15% their tax bracket requires of them. The effective tax rate for most households is usually less than their bracket and this is the only group for which this appears not to be the case. By our estimate that's about 2.8 million households, all of them in the fourth quintile of income earners in the United State, that are "overpaying" on their federal taxes. These are working class, hourly wage-earners, probably on the young end of things.

This seems odd, though we can think of a few reasons why this is the case. More on this later.

There are a number of effective tax rates that are comparable or higher to the median millionaires' rate for incomes well below seven figures. Krugman actually sells his point short about the number of wealthy people paying lower rates then their underlings: it's not just the bottom 40% of millionaires, it's probably most of them.

Which led us to this curious observation: the median effective tax rate paid by millionaires is actually less than it is for earners making $500,000-999,999 ... and by almost an entire percentage point too. That got us thinking: is this just a bump in an otherwise upward progression or does it essentially mark the crest of a "hook"?

There are a few numbers to suggest that this is actually the case. First, there are the incomes over $10 million:

In 2009, the $10m+ club paid a median effective income tax rate of about 22.4%, and among them the whales of the economy paid even less:

The number of Americans reporting incomes of $10 million or more also plunged even more than the steep drop in income for the population as a whole.

Just 8,274 taxpayers reported income of $10 million or more in 2009, down 55 percent from 18,394 in 2007. Compared with 2007, total real income of these top earners in 2009 fell 58.6 percent to $240.1 billion, but average income slipped just 8.1 percent to $29 million.

Since 1992, the I.R.S. has compiled data from the returns of the 400 Americans reporting the largest income. In 1992, the top 400 had aggregate taxable income of $16.9 billion and paid federal taxes of 29.2 percent on that sum. In 2008, the aggregate income of the highest 400 had soared to $90.9 billion — a staggering $227.4 million on average — but the rate paid had fallen to 21.5 percent.In 2006 the average rate was 17%.

As luck would have it, Forbes just published it's annual list of the 400 wealthiest Americans this week, so these are the folks we're talking about here. Last on the list is the Washington Redskin's less-than-popular owner Daniel Snyder at $1.05 billion.

So it would seem that once you become a millionaire in America, your effective tax rate actually decreases on average. Naturally, it's a little more complicated than that. We broken down some tax data from 2009 and found that the threshold is just a little bit higher:

$1-2 million = 25.3%Here's what it all looks like in graph form:

$2-5 million = 25.7%

$5-10 million = 25.25%

$10+ million (- wealthiest 400) = 22.95%

Wealthiest 400 = 21.5%*

This shouldn't be too surprising. Rich folks have more tax loopholes and charitable write-offs to take advantage of than the folks who were "overpaying" earlier. Those guys are likely on their own when it comes to tax breaks.

All too often folks defend the wealthy against charges of not paying their fair share by clumping them together in a group, as if they earned their wealth together as some kind of collective. The fact is that wealthy folks are individuals and as such they appear to be paying a lower effective tax rate than millions of people who earn less than they do. This comes after a generation spent giving Americans in the 40-99 percentile of earners more of the federal tax load since 1970, as this chart below shows:

Which looks like this in graph form:

Every time you see a line swerve above the green line in represents a raise in the tax rates. You can see this only happens for people not in the upper 1% of income earners. The rich have had a very nice run of things for the last generation and have given the country very little to show for it. It's time they give a little back.

* I basically took the data from three different years and combined them in order to extrapolate figures for recent years that I could not find. Is this shitty analytics? You bet, but it's the best I could do while killing an hour waiting for a phone call. If you can correct the numbers, by all means, do your stuff.

Wednesday, September 21, 2011

Jonathan Krause's Tax Policy Boot-licking

This blog is rapidly devolving into just a series of reactions to the senseless musings of Jonathan Krause and while that certainly does bother me, it doesn't seem to bother me more than the numerous ways in which Krause is wrong on an almost daily basis. Maybe I should pity someone who understands the world we live so little or marvel at the ability of someone so dense to function in society?

Today we were treated to yet another one of Krause oblivious anti-tax rants. As we've noted before, Krause usually confuses economic policy with his own sense of moral indignation and the old boy didn't disappoint this morning:

Next, let's actually flesh out these percentiles. If you make over $380,000 in 2010, congratulations, you are a part of America's economic ruling class: the top 1%. Among these rare creatures are the millionaires, who make up about 0.13% of all tax-payers. Here's a funky little chart to help us all out (click to embiggen).

Krause seems to think that we already tax the wealthy too much. The fact-checking piece he cites to refute Warren Buffett's claim to the contrary is entitled "The wealthy already pay more taxes." No one denies this and this is not what Warren Buffett was saying. The issue at hand is if the wealthy are paying enough taxes or their "fair share," as the President puts it. Let's look at Krause's numbers one more time:

But Krause can't even read the source he's citing correctly. Here's what the story Krause cites actually says:

For Krause to portray the wealthy in America as somehow being over burdened by their taxes is absurd.

What Krause funadamentally fails to understand is that the wealthiest 1% of Americans control 40% of the country's wealth. Full stop. This was before the recession. Most people think the income ineqaulity in this country has gotten worse. Now the top 1% does account for abut 40% of tax revenue, but that's hardly the tax burden the average millionaire must bare. Again, according to the very article Krause cites:

In 2009, taxpayers who made $1 million or more paid on average 24.4% of their income in federal income taxes, according to the IRS.

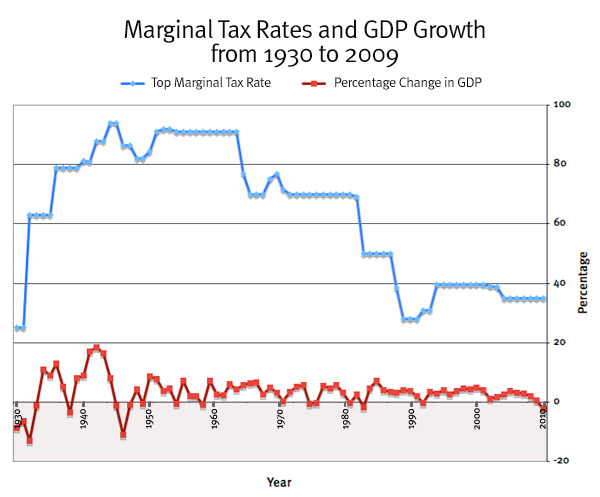

Keep in mind that nobody's talking about returning the rates to the levels of Reagan's first term, when the upper marginal income tax rate was about 50%. Asking millionaires to chip an additional 2-5% shouldn't seem unreasonable by comparison, especially given the howling conservatives like Krause do over the federal debt. Instead we get rhetoric about how the wealthy are the "job creators," the engines that power the economy, but this just talk. They may the masters of the econmic universe, but there's been no correlation between low tax rates for the wealthy and GDP growth:

Now bare in mind that nobody's talking about returning the rates to the levels of Reagan's firt term, when the upper marginal income tax rate was about 50%. Asking millionaires to chip an additional 2-5% shouldn't seem unreasonable by comparison, especially given the howling conservatives like Krause do over the federal debt.

But somehow it is. Somehow folks like Krause erupt into a fit when they hear plans to tax the upper 0.13% of Americans more, even though they are asked to do very little for their country ... like serve in the military, which draws heavily from lower income households.

Not that Krause has any understanding of lower income earners in America. Time and again he seems under the illusion that there's some kind of Big Poverty lobby that's out to screw him out of the money he earns spitting misinformation out over the airwaves. Few things embody this better then these lines:

The less income one makes, the less likely that person is to vote. In some places this can depress a turnout rate to less than 33% (and that's just what I found devoting 30 seconds to looking for an example -- there are likely far worse case studies out there). Fighting for the poor is typically bad politics, especially when the government already does so much for the wealthy.

If your a businessman who wants to get into China, you can go to the State Department and they will help you out, just like people who go to City Hall for building permit, only what the State Department does is significantly more expensive than what goes on at City Hall. If you have up to $250,000 in a savings account at a bank that goes under, the FDIC will cut you a check for your loses. The FDIC will also cut a check to some who lost $100 from the same bank, and they'll essentially "insure" both of these sums of money for the same price. People with wealth very frequently don't even have to wait in line to be heard by their governments -- all too often they are the first people consulted.

But let's forget all of this for a minute ... if raising taxes on the wealthy isn't the answer, as Krause so dickishly delineates, then what is? Why doesn't Krause tell us what we should be doing to repair the economy and eliminate the debt, because he's obviously has better solutions than the President, God knows how many real economists and Warren Buffett. I won't hold my breath waiting for anything constructive.

Today we were treated to yet another one of Krause oblivious anti-tax rants. As we've noted before, Krause usually confuses economic policy with his own sense of moral indignation and the old boy didn't disappoint this morning:

According to President Obama, 234,000 people are to blame for our current federal budget crisis.This is entirely incorrect. Krause can't point to one place where President Obama says this, insinuates this, or comes anywhere close to communicating this idea. This is purely Jonathan Krause putting words into the leader of the free world's mouth.

Those 234-thousand people are the households that reported incomes of at least $1-million dollars last year. And--according to the President--they are the ones who did not pay their "fair share" of taxes.How Krause equates the low tax rates among the highest earners in the country with causing "the current federal budget crisis" is not explained, but there's no need to spend too much time worrying about it: in Krause's mind people who do something wrong must pay a financial penalty. If you're unemployed, it's because you're lazy. If you're paying higher taxes, it's because you obviously must have done something wrong, like destroy the economy.

Those 234-thousand people are the one's targeted by the so-called "Buffett Rule" that the President is including in his new tax increase proposal. The "Buffett" referred to there is Warren Buffett, who claims his secretary pays a higher tax rate than he does. However, the "Oracle of Omaha" actually doesn't need a change in the Federal Tax Code to rectify that situation. He just needs to raise his salary from Berkshire Hathaway--which is taxed at a rate much higher than what his secretary would pay--and decrease what he claims as income from capital gains and dividends--which are taxed at a lower rate. Voila, Buffett is paying 35% in federal taxes--while his secretary (assuming she makes between 40- and 50-thousand dollars a year) will continue paying 15%.And here we have yet another perfect example of how Krause simply doesn't understand what the hell he's talking about. The reason why Buffett cites the disparity in tax rates he and his secretary pay is because his secretary doesn't have the option to claim much of her salary as capital gains. No one who derives their earnings from a salary does and that's most of America. Now, not all millionaires can do this, but many, if not most, can. It's also precisely because capital gains are taxed at a lower rate than income that Buffet is also pointing out a tax code that is replete with loopholes that benefit the wealthy.

According to an Associated Press "Fact Check" story, the top 10% of wage earners in the US pay 70% of all federal income taxes. The rest is picked up by those of us in the next 44% of wage earners. 46% of all Americans pay nothing in federal income taxes. And that final group is growing every year. Kind of makes you wonder who isn't paying their fair share. Of course, I'm not part of that 46% President Obama needs to scare/placate/over-promise to have any chance of winning election in 2012.First of all, kudos to Krause for finally learning to cite his sources. Now if he can only learn to process the information he gets from those sources...

Next, let's actually flesh out these percentiles. If you make over $380,000 in 2010, congratulations, you are a part of America's economic ruling class: the top 1%. Among these rare creatures are the millionaires, who make up about 0.13% of all tax-payers. Here's a funky little chart to help us all out (click to embiggen).

Krause seems to think that we already tax the wealthy too much. The fact-checking piece he cites to refute Warren Buffett's claim to the contrary is entitled "The wealthy already pay more taxes." No one denies this and this is not what Warren Buffett was saying. The issue at hand is if the wealthy are paying enough taxes or their "fair share," as the President puts it. Let's look at Krause's numbers one more time:

10% of wage earners in the US pay 70% of all federal income taxes. The rest is picked up by those of us in the next 44% of wage earners. 46% of all Americans pay nothing in federal income taxes.First of all, the canard that almost half of Americans pay nothing in taxes is a deliberate misrepresentation of basic demographics. According to the last census, 24.3% of Americans were seventeen years old or younger. That means if they did have a job it was mostly likely a part-time job that likely did not earn them to be taxed (In fact, all of these individuals are considered to be dependents and represent tax deductions). Also, 12.9% of Americans are 65 years old or older. These folks are most likely retired and live off a fixed income like Social Security, a pension or what have you. That's 37.2% of Americans right there, so what we're really taking about are 8.8% of working aged Americans who aren't paying income taxes... if we're using Krause's numbers.

But Krause can't even read the source he's citing correctly. Here's what the story Krause cites actually says:

The Tax Policy Center estimates that 46% of households, mostly low- and medium-income households, will pay no federal income taxes this year. Most, however, will pay other taxes, including Social Security payroll taxes.Got that? Even the most poor will still pay taxes, a concept that usually evades Krause. Also escaping Krause is the changing nature of these folks. The 46% of Americans who aren't paying taxes this year are increasingly people who paid a lot of taxes in prior years. That's because they are very well-educated people who had relatively high-paying jobs until recently. Krause would have all his readers/listeners believe that the unemployed are lazy leaches sucking dry the producers of society. This is increasingly a remarkably irresponsible way of looking at the situation.

For Krause to portray the wealthy in America as somehow being over burdened by their taxes is absurd.

What Krause funadamentally fails to understand is that the wealthiest 1% of Americans control 40% of the country's wealth. Full stop. This was before the recession. Most people think the income ineqaulity in this country has gotten worse. Now the top 1% does account for abut 40% of tax revenue, but that's hardly the tax burden the average millionaire must bare. Again, according to the very article Krause cites:

In 2009, taxpayers who made $1 million or more paid on average 24.4% of their income in federal income taxes, according to the IRS.

Keep in mind that nobody's talking about returning the rates to the levels of Reagan's first term, when the upper marginal income tax rate was about 50%. Asking millionaires to chip an additional 2-5% shouldn't seem unreasonable by comparison, especially given the howling conservatives like Krause do over the federal debt. Instead we get rhetoric about how the wealthy are the "job creators," the engines that power the economy, but this just talk. They may the masters of the econmic universe, but there's been no correlation between low tax rates for the wealthy and GDP growth:

Now bare in mind that nobody's talking about returning the rates to the levels of Reagan's firt term, when the upper marginal income tax rate was about 50%. Asking millionaires to chip an additional 2-5% shouldn't seem unreasonable by comparison, especially given the howling conservatives like Krause do over the federal debt.

But somehow it is. Somehow folks like Krause erupt into a fit when they hear plans to tax the upper 0.13% of Americans more, even though they are asked to do very little for their country ... like serve in the military, which draws heavily from lower income households.

Not that Krause has any understanding of lower income earners in America. Time and again he seems under the illusion that there's some kind of Big Poverty lobby that's out to screw him out of the money he earns spitting misinformation out over the airwaves. Few things embody this better then these lines:

46% of all Americans pay nothing in federal income taxes. And that final group is growing every year. Kind of makes you wonder who isn't paying their fair share. Of course, I'm not part of that 46% President Obama needs to scare/placate/over-promise to have any chance of winning election in 2012.No, Krause is a part of he 54% the other side has to scare/placate/over-promise with pledges to never raise taxes under any circumstances, no matter how unlikely it will ever be that Krause ever reaches the upper 1% tax bracket.

The less income one makes, the less likely that person is to vote. In some places this can depress a turnout rate to less than 33% (and that's just what I found devoting 30 seconds to looking for an example -- there are likely far worse case studies out there). Fighting for the poor is typically bad politics, especially when the government already does so much for the wealthy.

If your a businessman who wants to get into China, you can go to the State Department and they will help you out, just like people who go to City Hall for building permit, only what the State Department does is significantly more expensive than what goes on at City Hall. If you have up to $250,000 in a savings account at a bank that goes under, the FDIC will cut you a check for your loses. The FDIC will also cut a check to some who lost $100 from the same bank, and they'll essentially "insure" both of these sums of money for the same price. People with wealth very frequently don't even have to wait in line to be heard by their governments -- all too often they are the first people consulted.

But let's forget all of this for a minute ... if raising taxes on the wealthy isn't the answer, as Krause so dickishly delineates, then what is? Why doesn't Krause tell us what we should be doing to repair the economy and eliminate the debt, because he's obviously has better solutions than the President, God knows how many real economists and Warren Buffett. I won't hold my breath waiting for anything constructive.

Sunday, September 18, 2011

Jonathan Krause's Randy Marsh Impersonation

There was a stunning degree of bullshit in Jonathan Krause's Friday blog post, but it does serve as a pretty good example of how Krause is usually wrong and why.

Here we go:

When Krause does start actually talking about causes contributing to a general lack of consumer spending he gets his facts embarrassingly wrong:

This entire bit about energy costs rising due to mandatory environmental regulations is complete and total nonsense. At the very most, oil refining composes about 7% of the total cost of any gallon of gas one buys. That's it. So even if we could say that the entire refining process is devoted to complying with Krause's phantom environment regulations, which we can safely say is not the case, it would only add a pittance to the cost of energy prices.

And here's why:

What about home energy costs, like heating and electricity? Right now most homes (64.3%) in Wisconsin are powered by coal, while another 20.6% by nuclear energy ... with only 3.8% coming from the awful renewable energy sources that are supposedly costing us so much money. Again, Krause really doesn't have much of leg to stand on with this claim.

Krause then goes after President Obama's jobs plan:

And how much did those tax cuts cost, since they weren't off-set with any spending cuts?

Krause can't have it both ways.

If a small business owner was really intent on hiring a member of the long-term unemployed for the purposes of collecting a tax credit (or whatever reason), the numbers suggest he could hire and fire numerous employees before finding the right fit. There's no sense in keeping the wrong people on in a bad economy because it's essentially an employer's market. Hiring the long-term unemployed is actually a good idea for most employers because they tend to be willing to take a salary lower than what they may actually be worth.

Now watch Krause uses a dickish tone to completely miss the point

That would be the government. The tax credits proposed in Obama's jobs plan are intended to incentivize hiring by firms who can staff up or are still on the fence about doing so. The hope is that if enough employers take advantage of the incentives it will kick-start the economy an spur other employers into hiring binges of their own. Whether this works or not is subject to debate, but Krause' argument actually demonstrates just how badly some kind of government intervention is needed to kick-start the economy -- he's just not bright enough to realize it.

The rest of the post is rather pedestrian whining from Krause and includes a breathlessly vacuous defense of Wall Street which demonstrates that Krause really doesn't have the first fucking clue why the economy crashed. This creates something of a problem when searching for solutions to problems, but that's not something that really bothers Krause. In the end he eschews possible remedies for feigning empathy with people who actually have some skin in the game:

Not much. Krause's post advocates the exact position that Randy Marsh promoted in this classic South Park episode: you're stupid to be spending your money now. This won't help the economy, it will only make it worse ... much, much worse.

Here we go:

I'm glad I'm not a business owner right now. You're facing a dwindling customer base with less money to spend, rising expenses and now, people in Washington who have never run a private business in their lives pressuring you to make really bad decisions--all in the name of "saving the economy."Ants and grasshoppers. Notice how this bullshit construction is based not on economic figures, models or theory, but on the moral sentiment which states that those who do not prepare for hard times deserve their suffering. So when Krause claims to be talking about economics, he's really talking about his own personal sense of morality.

Americans are falling into two groups: Those with no money to spend because they un- or under-employed and didn't put enough away while working to make it through a downturn--and those who have money, but are choosing to sit on it because it looks like things will be getting much more expensive for them in the future--or they fear falling into the other category. No matter how low you go with your prices, it's hard to convince people to part with their cash if what you are selling is not a necessity.

When Krause does start actually talking about causes contributing to a general lack of consumer spending he gets his facts embarrassingly wrong:

Adding to the struggle is the increase in energy costs as utilities are hog-tied and forced to abandon the cheapest forms of electricity in favor of more expensive renewable sources--and continued de-valuation of the US Dollar increases the price of oil and gasoline. And not only are you paying for your increase in energy costs--but you are also picking up the increase in your suppliers and manufacturers power and gas bills as well.A good rule of thumb: any time someone ascribes anything other than market forces to fluctuations in the price of energy, they are full of shit. This is a problem for libertarians like Krause, who have a tendency to celebrate the market and deregulation when it does something amazing, like reinvent the brewing industry, but it's never spoken of when gas tops $4 a gallon. Basically, this is like wide receivers who always thank God when they catch the clutch pass to win the game, but never blame Him when they drop it.

This entire bit about energy costs rising due to mandatory environmental regulations is complete and total nonsense. At the very most, oil refining composes about 7% of the total cost of any gallon of gas one buys. That's it. So even if we could say that the entire refining process is devoted to complying with Krause's phantom environment regulations, which we can safely say is not the case, it would only add a pittance to the cost of energy prices.

And here's why:

[Crude oil] is the raw material used to make commercial-grade gasoline, known in much of the world as petrol. The cost of crude oil accounts for the largest percentage of what U.S. consumers pay for gas at the pump. On average, about 51 percent of every dollar spent on retail gasoline went to crude suppliers in much of the last decade, according to the EIA.So currently 70% of gas costs go to raw materials, while 7% goes to refining where most environmental regulations, like ethanol addition, are enforced. Even if Krause is talking about the environmental regulations that prevent drilling in certain areas, and which would be added to the price of the raw material, these regulations don't add all that much the price paid by the consumer:

In 2008, when gas and oil prices were at their highest, crude represented an average of 75 percent of U.S. gas prices and currently hovers at around 70 percent (PDF), according to April 2011 analysis from oil industry advocate the American Petroleum Institute (API). "You cannot decouple gas prices from crude prices," says one API analyst. "If you want to help the consumer at the pump, you have to make sure crude prices don't rise too much."

A 2004 study by the government's Energy Information Administration (EIA) found that drilling in ANWR would trim the price of gas by 3.5 cents a gallon by 2027. (If oil prices continue to skyrocket, the savings would be greater, but not by much.) Opening up offshore areas to oil exploration — currently all coastal areas save a section of the Gulf of Mexico are off-limits, thanks to a congressional ban enacted in 1982 and supplemented by an executive order from the first President Bush — might cut the price of gas by 3 to 4 cents a gallon at most, according to the Natural Resources Defense Council. And the relief at the pump, such as it is, wouldn't be immediate — it would take several years, at least, for the oil to begin to flow, which is time enough for increased demand from China, India and the rest of the world to outpace those relatively meager savings.It's not environmental regulations that are causing gas prices to increase, it's the fact that the bulk of the world's oil supply is controlled by a cartel that dictates supply during a time of increasing demand. The end.

What about home energy costs, like heating and electricity? Right now most homes (64.3%) in Wisconsin are powered by coal, while another 20.6% by nuclear energy ... with only 3.8% coming from the awful renewable energy sources that are supposedly costing us so much money. Again, Krause really doesn't have much of leg to stand on with this claim.

Krause then goes after President Obama's jobs plan:

And now, the President is trying to tempt you into expanding your workforce by offering short-lived tax breaks. It's funny how Mr. Obama touts the temporary reduction in payroll taxes--but conveniently forgets to mention the increased rates that would take effect after the 2012 election.Krause is speaking of the fabeled Bush Tax Cuts, which have been nothing short of disastrous. Many of the recipients of the Bush tax cuts are doing quite well despite the weak economy, thank you very much:

[B]etween 2001 and 2008, the bottom 80 percent of filers received about 35 percent of the cuts. The top 20 percent received about 65 percent—and the top 1 percent alone claimed 38 percent.

What about the president's claims? Take his pledge that the cuts would spur job growth. To be fair, we'll ignore employment changes during 2008, the year the Great Recession seized the economy. During the 2001 to 2007 business cycle, America's economy enjoyed 52 straight months of job growth. But it was sluggish—in fact, the slowest rate of jobs growth on record since World War II, and just one-fifth the pace of the 1990s.Why did this happen? Because the wealthy, who received the lion's share of the tax cuts, saved their tax cuts rather than spending it, according to a study by Moody's.

And how much did those tax cuts cost, since they weren't off-set with any spending cuts?

Total income was $2.74 trillion less during the eight Bush years than if incomes had stayed at 2000 levels.And the tax cuts were the single largest contributor to the national debt:

Krause can't have it both ways.

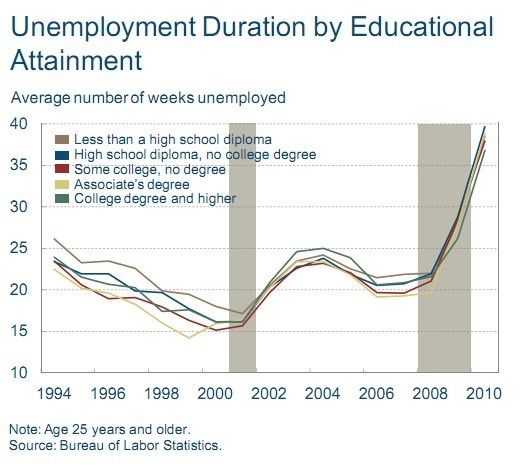

And the only way to get the highly-touted tax credits is to hire someone who has been unemployed for more than a year. Yes, some of those long-term unemployed are in situations where the specialized job they are qualified to do just isn't available in the "New, New, New Economy"--but more are people who lack the basic education and work skills to keep a job.This is simply not true. In fact, length of unemployment is becoming a problem regardless of education:

That makes a business owner have to decide if the guy who misses a day of work every week because he is "sick again" is worth the cost of a tax-break.Again, notice how Krause reverts to a moral assessment of the unemployed: clearly the unemployed are that way because they're lazy and employers who hire them must be stupid. In fact, just the opposite is true.

If a small business owner was really intent on hiring a member of the long-term unemployed for the purposes of collecting a tax credit (or whatever reason), the numbers suggest he could hire and fire numerous employees before finding the right fit. There's no sense in keeping the wrong people on in a bad economy because it's essentially an employer's market. Hiring the long-term unemployed is actually a good idea for most employers because they tend to be willing to take a salary lower than what they may actually be worth.

Now watch Krause uses a dickish tone to completely miss the point

I know most business owners in our area didn't study Keynsian Economics while attending Harvard--so they aren't qualified to know how things work--but those I do know don't hire or increase production in hopes that more people will start pouring through the doors. Usually in the real economy, you wait for demand to increase beyond the point where you can meet it economically--then you bring in more staff and ramp up production. If no one is buying snowthrowers, you don't keep making snowthrowers thinking that if they see enough sitting around for sale Joe Homeowner is going to suddenly want a new one.Ta-da! Krause has finally arrived at the problem: private companies aren't hiring and people aren't spending. So if the jolt that will revive the economy isn't coming from consumers, and it's not coming from banks that aren't lending (as Krause will discuss in the next graph), and it's not coming from the companies that aren't hiring -- where's it going to come from? We've pretty much covered the entire private sector just now, so ... who's left?

That would be the government. The tax credits proposed in Obama's jobs plan are intended to incentivize hiring by firms who can staff up or are still on the fence about doing so. The hope is that if enough employers take advantage of the incentives it will kick-start the economy an spur other employers into hiring binges of their own. Whether this works or not is subject to debate, but Krause' argument actually demonstrates just how badly some kind of government intervention is needed to kick-start the economy -- he's just not bright enough to realize it.

The rest of the post is rather pedestrian whining from Krause and includes a breathlessly vacuous defense of Wall Street which demonstrates that Krause really doesn't have the first fucking clue why the economy crashed. This creates something of a problem when searching for solutions to problems, but that's not something that really bothers Krause. In the end he eschews possible remedies for feigning empathy with people who actually have some skin in the game:

So that is the decision Mr and Mrs Small Business Owner faces now: Take a giant leap of faith that things are suddenly going to turn around because Uncle Sam is going to spend even more money--and risk losing everything you worked hard to build....or exercise sound business judgement and hang on until people are ready to spend again and ride the wave back to success. Glad I don't have to face that decision.It really doesn't look like we can count on Mr. & Mrs. Small Business Owner to get the economy up and running, can we? It's just not in their best interests to take any risks right now. Using tools like tax credits, the government can help to mitigate some risks. Since any more stimulus is anathema to libertarian like Krause, what more is left on the table?

Not much. Krause's post advocates the exact position that Randy Marsh promoted in this classic South Park episode: you're stupid to be spending your money now. This won't help the economy, it will only make it worse ... much, much worse.

Thursday, September 15, 2011

Jonathan Krause's Rhineland Ubermenchen are, Statistically Speaking, Pretty Lazy

Jonathan Krause usually has a hard enough time trying to make sense of events that occur in his own back yard, let alone those that occur on the other side of the planet, so when he starts getting into the intricacies of global finance, it's usually a sign to whip out one's Bullshit Shovel and start digging.

And Tuesday's post was no exception.

Tucked into a lazy doom and gloom sermon on China's involvement as a potential Eurozone bailout Savior is this ode to his ancestoral homeland (assuming, of course, that Krause is, in fact, as German as it sounds):

Well, let's take a look at this monstrosity line by line.

1.) The German Constitutional Court didn't approve of the bailouts, it found that the German parliament had the authority to spend that money. There's a considerable difference. In fact, the court made it easier on parliament to approve such bailouts:

2.) The ruling majority coalition in Germany is headed by the conservatives. Angela Merckel, Germany's prime minister, is head of the Christian Democratic Union. Now if that doesn't sound like a very conservative party name then consider that the opposition coalition is composed of the German Social Democrats, the Greens and a socialist party that simply calls itself The Left. Conservatives are not the minority as Krause claims.

3.) And, more to the point, the CDU has been pushing for the Greek bailout because it threatens to undermine the entire Eurozone (and, by extension, the Euro currency), something that Germany has been a principle backer of since Day One.

Here are the total number of mandatory paid vacation days, plus public holidays, per each of the countries Krause mentions:

Boy, am I glad we got over those stereotypes 60 years ago...

And Krause is just getting started being wrong. When looking at the actual number of hours worked on an annual basis, Germans are blown away by other Europeans. In fact, they work fewer hours on average than just about anyone else in the industrialized world, including, wait for it ... Greece.

In fact, Greeks work 49% longer for 17% less than Germans (and 18% longer for 42% less than Americans). So you can see where Greeks might take offense to being called lazy.

First, it's important to note -- since Krause omits this detail -- that just because one can retire at a certain age, doesn't mean someone will do so. This chart, unfortunately based on OEDC data whose link is broken, seems to suggest that the average retirement ages in Greece and Germany are actually quite similar and are somewhere in the early to mid-60s. In fact, it almost looks like Greeks tend to retire later than Germans:

(Also worth pointing out here is that the average retirement age in Austria, which is basically a Junior Varsity Germany, is 59, to which I likely join the rest of the world in saying, "Huh?")

But let's keep on looking at Greek retirement using the numbers Krause wants us to see. If, as the OEDC numbers state, the average Greek worker spends about three more months than the average German worker does at the office over the course of the year, then that same Greek worker will work 8.4 years more than the average German worker during the course of a 35 year career between the ages of 20 and 55. That means the average Greek worker has put in just as much time at work by the age of 55 as the the average German worker does by the age of 63 and a half. So it's not exactly like Greeks are getting an extra ten years of lounging around the retirement home. Hour for hour, at least according to the figures Krause wants us to believe, they put in equal time.

Unfortunately, not all work hours are created equal, as we'll see later.

The second, and more critical aspect that Krause ignores, is Greece's recent history and how those generous retirement packages came about.

Greece quietly had a very chaotic 20th Century. Here's as concise a history as it relates to the current economic troubles as you will find:

The Greek retirement system is a mess, but solutions will take more than simply pointing to Germany and saying "Do that!" There are social and political considerations here that most Germans, understandability annoyed at their new relationship with Greece, probably aren't aware of, just like Krause.

(Just so we don't ignore the second part of Krause's contention: youth unemployment in Britain is not seen as "acceptable." It's a problem that frustrates both the Tory-led ruling coalition and the Labour shadow government, and has been given all the more attention since the recent riots in London. I simply don't know where he's getting this.)

Last, but not least, we get to the gist of Krause's piece:

I don't think I need to explain why. As we noted above, Germans work significantly fewer hours than just about any industrialized country on earth, and yet they have the fifth highest GDP on Earth. This happens because when they are at the office, they work; and when it's time to leave, they leave.

Americans do not subscribe to this philosophy. We tend to judge a person's "work ethic" not by their productivity, but by total number of hours spent at the office. The last guy to leave the office at night is always called "a hard worker" and almost never "the guy who dicked around the break room for four hours this afternoon and is now trying to play catch-up." This is probably why Krause is under the illusion that Germans never seem to take vacations and work 16 hour days.

Which bring me back to the point about all work hours not being created equal. Germany's work hour is usually held up as the gold standard of employee productivity, but it's export to other countries is unlikely. Greece, where Krause clearly thinks German values will do good, is an ancient culture that is not likely to accept them. Nor, for that matter, is a place like the United States, which already has tens of millions of citizens of German heritage in her borders.

In fact, it's no small wonder that Krause praises his ancestral homeland so effusively. Germany, after all, was the birthplace of the welfare state. It also invented the idea of retirement in the first place. It continues to have a top-notch and universal health care system of the kind that Krause loathes. It not only participates in, but helped found, an unwieldy economic alliance with it's neighbors -- an act of multilateralism Krause frequently scoffs at. It has very strict labor laws that cap the number of hours someone can work during a week, which according to Krause's libertarian ideology is government control of income and a policy that stifles entrepreneurship.

And yet despite all of these "job killing policies" the unemployment rate, GDP growth rate and even social mobility are better in Germany than in the United States.

If you've gotten this far then I should perhaps remind you that Krause's original post was actually not about Germany, but China. Krause takes his usual pot shot at "Keynsian economists," a phrase he frequently demonstrates no understanding of, before launching into this rather bizarre conclusion:

BTW: I'm going to cast a skeptical eye on Krause's suggestion that Chinese manufacturing firms are farming out labor to places like Vietnam en masse. This sounds like something someone with very little knowledge of an issue would create out of whole clothe to make a situation sound worse than it actually is. Given how large and notoriously corrupt China is, it would not surprise me if a few companies did such business or, what's more likely, that American firms had manufacturing operations in both Vietnam and China, but usually the cost of doing business in China is paying Chinese labor, something most Western firms are more than happy to do.

China isn't necessarily interested in making it's wealthy citizens even more wealthy then they already are, but it does want to create the large and robust middle class that will take it into the 21st century. That means getting the peasants out of the countryside, where little has changed since the 19th century in many cases, and getting them into the cities. The best way to do this is thought manufacturing jobs that make subsistence farming look silly. To accomplish this China is undertaking the largest redistribution of wealth project ever conceived. It's essentially a gigantic New Deal program that being funded entirely with foreign cash; socialism integrated into the globalization created by capitalism.

And Tuesday's post was no exception.

Tucked into a lazy doom and gloom sermon on China's involvement as a potential Eurozone bailout Savior is this ode to his ancestoral homeland (assuming, of course, that Krause is, in fact, as German as it sounds):

The fact that China is entering into the Euro disaster zone must mean that Germany is tapped out in trying to help keep its neighbors afloat. I know the German bailout of several other countries had to be approved by the nation's Supreme Court--as the conservative political minority was fed up with being the Continental ATM Machine. And how could you blame them for having that attitude? You don't see Germans taking the entire month of August off of work like Spain and Italy. German seniors don't get full retirement benefits at 55 like in Greece and there is no acceptance of permanent unemployment for the younger generations like in Britain. The term "German work ethic" didn't come about by accident--it was earned.Le sigh ...

Well, let's take a look at this monstrosity line by line.

The fact that China is entering into the Euro disaster zone must mean that Germany is tapped out in trying to help keep its neighbors afloat.Nope. Not at all, in fact. China is likely acting independently of Germany in an effort to expand it's global economic influence. It's a brilliant strategy, really; and who wouldn't buy that kind of influence when you have such a rapidly growing economy. Germany probably has the capital to at least partially fund another bailout here or another bailout there, but the primary issue with these things is rarely the availability of financial capital, but the political capital (recall the popularity of the U.S. bailout of Mexico is the early 1990s, for example); and in Germany no one's really amped about giving money away.

I know the German bailout of several other countries had to be approved by the nation's Supreme Court--as the conservative political minority was fed up with being the Continental ATM Machine.This sentence is a hot mess for at least three reasons.

1.) The German Constitutional Court didn't approve of the bailouts, it found that the German parliament had the authority to spend that money. There's a considerable difference. In fact, the court made it easier on parliament to approve such bailouts:

Yes, the German parliament must have a say on every individual German payout into future euro zone bailout structures. But, conscious of the tension between market efficacy and democratic legitimacy, future payments need only the approval of the Bundestag’s budgetary committee and not the entire parliament.This is essentially the same thing as the U.S. Supreme Court saying that some bills don't need to be voted on by the entire House of Representatives (or even the Senate), but as soon as it makes it out of a certain committee it becomes law. (The bigger philosophical issue here is how much aithority does the German Prime Minister has to unilaterally appropriate money for "foreign" bailouts -- foreign being something of a tricky word in the context of the Eurozone where every country has entered into a shared economic agreement. The German high court basically said the PM can't do alone, but doesn't need all that much approval from Parliament. That's right, folks: Germany is vesting more power in its executive.) Off hand, I can't think of any instance where the Supreme Court has dictated rules to the legislative branch of government and would imagine that the principle of the separation of powers would not allow it.

2.) The ruling majority coalition in Germany is headed by the conservatives. Angela Merckel, Germany's prime minister, is head of the Christian Democratic Union. Now if that doesn't sound like a very conservative party name then consider that the opposition coalition is composed of the German Social Democrats, the Greens and a socialist party that simply calls itself The Left. Conservatives are not the minority as Krause claims.

3.) And, more to the point, the CDU has been pushing for the Greek bailout because it threatens to undermine the entire Eurozone (and, by extension, the Euro currency), something that Germany has been a principle backer of since Day One.

And how could you blame them for having that attitude? You don't see Germans taking the entire month of August off of work like Spain and Italy.Actually, they do. Here's an article that took me all of three seconds to find on Google:

It's typical for Germans to take off three consecutive weeks in August when "most of the country kind of closes down," Schimkat said. That's the time for big trips, perhaps to other parts of Europe, or to Australia or North America. Germans might also book a ski holiday in the winter and take a week off during Easter.So just like the rest of Europe Germany closes for the month of August and Krause couldn't be more incorrect on that account. Or could he?

Here are the total number of mandatory paid vacation days, plus public holidays, per each of the countries Krause mentions:

Germany = 34So the mighty Teutonic laborers of the Black Forest actually do take as much time off as their lazy olive-skinned counterparts along the Mediterranean.

Greece = 37

Italy = 31

Spain = 36

United States = 25

Boy, am I glad we got over those stereotypes 60 years ago...

And Krause is just getting started being wrong. When looking at the actual number of hours worked on an annual basis, Germans are blown away by other Europeans. In fact, they work fewer hours on average than just about anyone else in the industrialized world, including, wait for it ... Greece.

Korea = 2193If we ignore vacation time and assume a rigidly enforced eight hour work day, Germans work 30.5 cumulative fewer days than Spaniards, almost 45 days less than Italians and Americans, and a whopping 86.25 fewer days -- that's almost three months! -- than those good for nothing Greeks who got us into this mess in the first place. Viewed in these terms vacation days are almost negligible.

Greece = 2109

Russia = 1976

Italy = 1778

United States = 1778

Spain = 1663

Germany = 1419

In fact, Greeks work 49% longer for 17% less than Germans (and 18% longer for 42% less than Americans). So you can see where Greeks might take offense to being called lazy.

German seniors don't get full retirement benefits at 55 like in Greece and there is no acceptance of permanent unemployment for the younger generations like in Britain.Now here is the trickiest knot of Krause's bombast to untangle because there is an element of truth to his criticism that Greece has a messy and unseemly retirement system. There's no denying this, but the underlying truth that Krause ignores, or more likely is ignorant about, is how this came to be (which we'll get to in a moment).

First, it's important to note -- since Krause omits this detail -- that just because one can retire at a certain age, doesn't mean someone will do so. This chart, unfortunately based on OEDC data whose link is broken, seems to suggest that the average retirement ages in Greece and Germany are actually quite similar and are somewhere in the early to mid-60s. In fact, it almost looks like Greeks tend to retire later than Germans:

(Also worth pointing out here is that the average retirement age in Austria, which is basically a Junior Varsity Germany, is 59, to which I likely join the rest of the world in saying, "Huh?")

But let's keep on looking at Greek retirement using the numbers Krause wants us to see. If, as the OEDC numbers state, the average Greek worker spends about three more months than the average German worker does at the office over the course of the year, then that same Greek worker will work 8.4 years more than the average German worker during the course of a 35 year career between the ages of 20 and 55. That means the average Greek worker has put in just as much time at work by the age of 55 as the the average German worker does by the age of 63 and a half. So it's not exactly like Greeks are getting an extra ten years of lounging around the retirement home. Hour for hour, at least according to the figures Krause wants us to believe, they put in equal time.

Unfortunately, not all work hours are created equal, as we'll see later.

The second, and more critical aspect that Krause ignores, is Greece's recent history and how those generous retirement packages came about.

Greece quietly had a very chaotic 20th Century. Here's as concise a history as it relates to the current economic troubles as you will find:

Emphasis added because it's an extremely perceptive point. The division in Greek society actually started a generation earlier, toward the end of WWI when between 1-1.5 million Greeks returned home after the end of Greek occupation of parts of the Ottoman Empire following the war for Turkish Independence. Reintegration of these folks back into the Greek economy was not easy. One of the reasons Greece is in this mess is because people who had been marginalized by Greek politics for between 30-60 years took power in the mid-1970's and spent the next 25 years trying to compensate for being shut out. (Michael Lewis goes into graphic detail over just how badly this has broken the legitimacy of any government in power in Greece in a breezy read here.)The late Andreas Papandreou’s [the former Greek prime minister] strategy in the 1980s was to give the disenfranchised, who formed the bulk of PASOK’s [the dominant socialist party in Greece] voters, a shot at living like the middle class. If this meant throwing European assistance and subsidies around like political favors and giving pensions to people who had never contributed to social security (such as farmers), then so be it. At last, all those who had been shut out by the right-wing establishment which triumphed in the Civil War in 1946-49 – and which was thoroughly discredited by the dictatorship of 1967-74 – would get to share in the wealth of the nation. The fact that this new middle class was founded on wealth that the country was not producing meant that the economy broke free from all logic and went into its own orbit. PASOK established the National Health System and poured money into education but it also undermined the gains by destroying any semblance of hierarchy, accountability and recognition of merit in the public sector. This meant that no one really knew how much money was being spent nor whether those who deserved it most were getting it. Costs rose while productivity plummeted. A wasteful public sector, in turn, condemned the private sector to inefficiency and lack of competitiveness. New Democracy [the Greek conservative party], especially in the 2004-09 period, made the situation worse by doing almost nothing to cut costs and increase revenues, allowing the economy to career out of control.The Greek civil war, and the bloody score-settling that followed, is a living memory for many Greeks. Any consideration of Greek nepotism or clientelism needs to be seen in that light. So for example, it is not enough to say that Greek civil servants enjoy jobs for life, and that is a big problem. (Though it is a big problem, not least because many Greek civil servants are paid pitiful wages—partly because there are so many of them. That means they will resist austerity measures all the harder, because they feel like victims in this crisis, not fat cats.)

The Greek retirement system is a mess, but solutions will take more than simply pointing to Germany and saying "Do that!" There are social and political considerations here that most Germans, understandability annoyed at their new relationship with Greece, probably aren't aware of, just like Krause.

(Just so we don't ignore the second part of Krause's contention: youth unemployment in Britain is not seen as "acceptable." It's a problem that frustrates both the Tory-led ruling coalition and the Labour shadow government, and has been given all the more attention since the recent riots in London. I simply don't know where he's getting this.)

Last, but not least, we get to the gist of Krause's piece: